How to Download 26AS

How to Download 26AS

On 7th of June 2021, the income tax department of India launched its new website eportal.incometax.gov.in that aims to simplify income tax return (ITR) filing process for taxpayers. The portal, as the Ministry of Finance says, has simplified the download feature of form 26AS as well.

Form 26AS is the annual consolidated statement that contains tax credit information of each taxpayer against his PAN. It provides details of any tax deducted (TDS) or collected (TCS) from various sources of income of a taxpayer. The new Form 26AS, which is effective from 1st June, 2020 now also reflects the following details along with TDS and TCS:

Parts of 26AS:

How to view Form 26AS?

It is always advisable to view 26AS before filing the income tax return to check the amount of tax deposited in taxpayer’s account with the Income Tax Department. There are two ways to view and download 26AS:

1. The taxpayer can log in to his income tax filing account on the Income Tax Department’s e-filing website.

2. The taxpayer can view Form 26AS from FY 2008-09 onwards through his net banking account held with any authorised bank if his PAN is linked to such bank account. Following banks are registered with NSDL for providing a view of Tax Credit Statement (Form 26AS) :

How to download Form 26AS from the e-filing website?

To download and view Form 26AS from Income Tax Department’s website, simply follow the steps below:

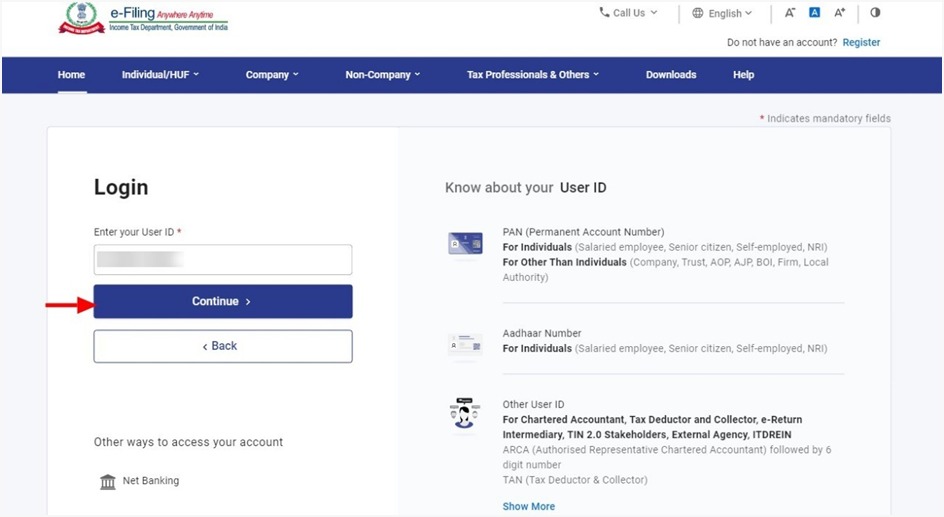

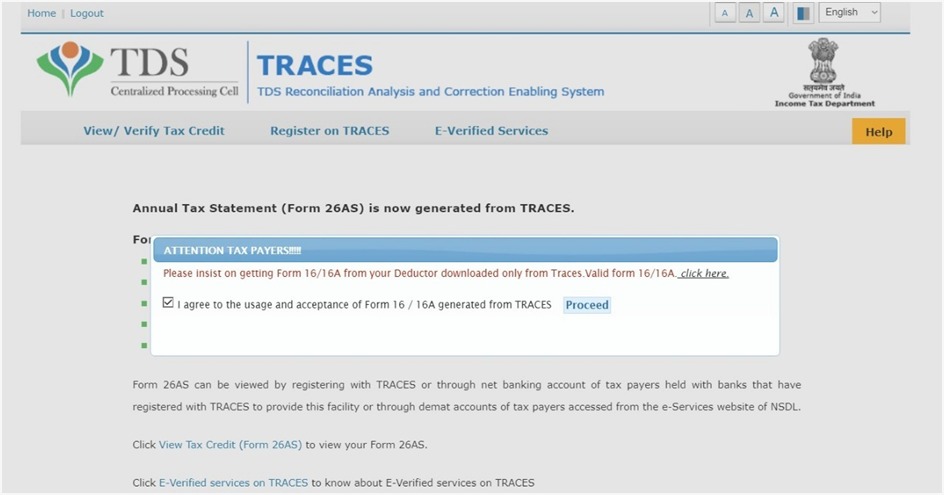

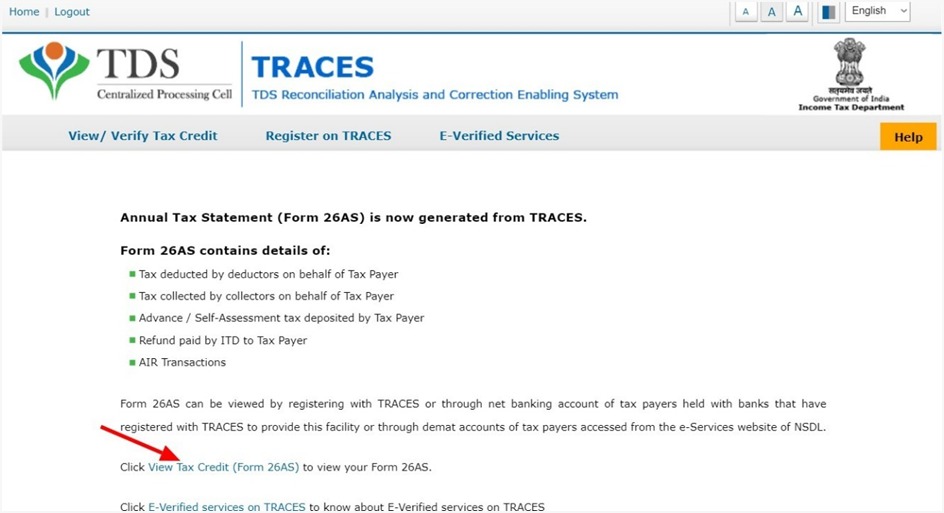

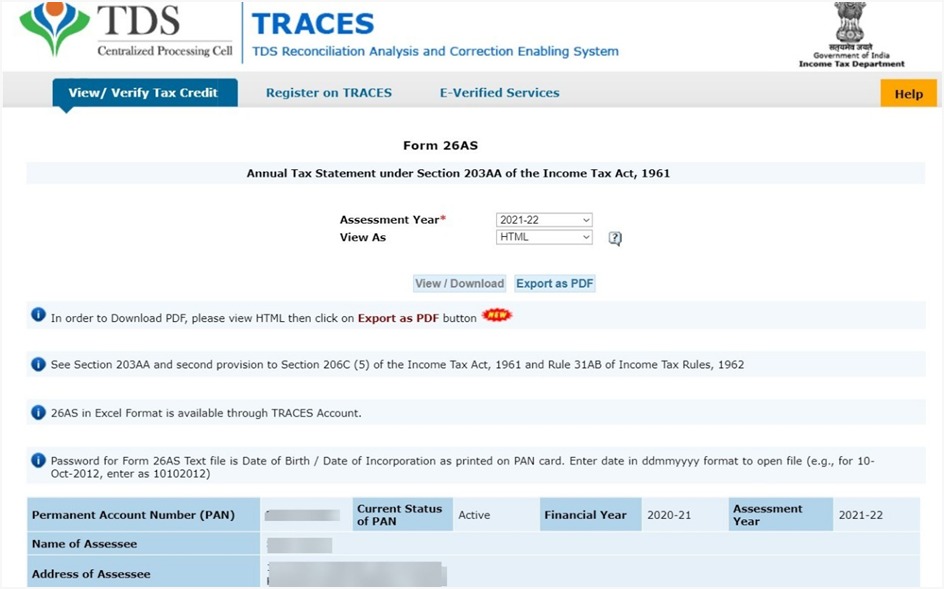

Step - 1

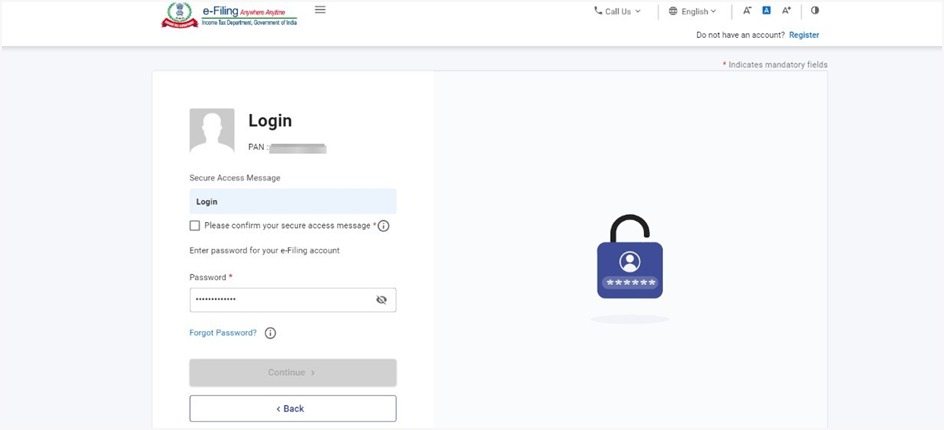

Step - 2

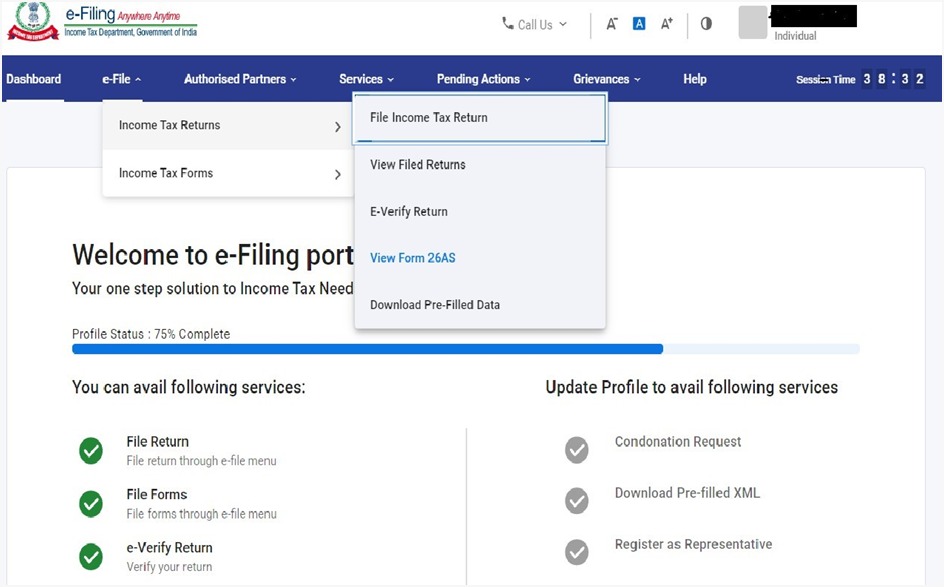

Step - 3

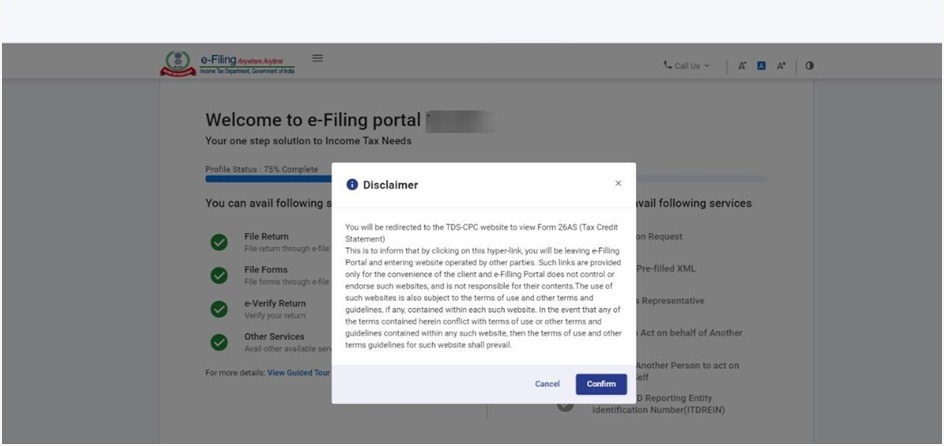

Step - 4

Step - 5

Step - 6

Step - 7

Step - 8

After downloading you can view the Form 26AS by clicking on it.

How to view Form 26AS using internet banking account held with authorised bank?

To view Form 26AS using net banking account follow the given steps:

Step - 1

Login to your bank’s internet banking website using your login ID and password.

Step - 2

After logging in, click on the option ‘Tax Credit Statement’ or ‘TRACES (26AS) Services’ to view your Form 26AS.

Service