How to e-verify your Income Tax Return (ITR)

Income Tax Verification - e Verify ITR using Different Methods

Filing your ITR is not the last step of the process. It is equally important to e verify your ITR. The Income Tax Department (ITD) processes your return only after the completion of the verification process of the ITR. Moreover, only returns that have been verified are eligible for refunds. Additionally, if you do not verify your return, it will be treated as an invalid return. Therefore, in this case, you will have to file a belated return.

INDEX

Prerequisites to Verify ITR

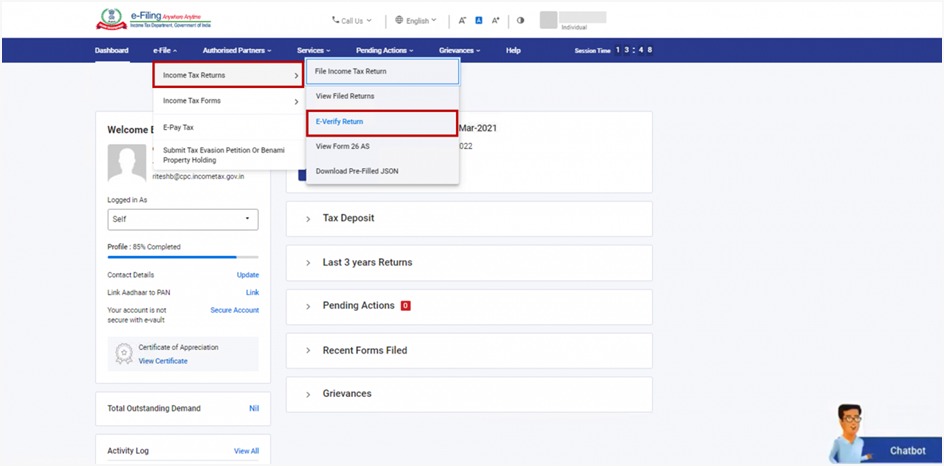

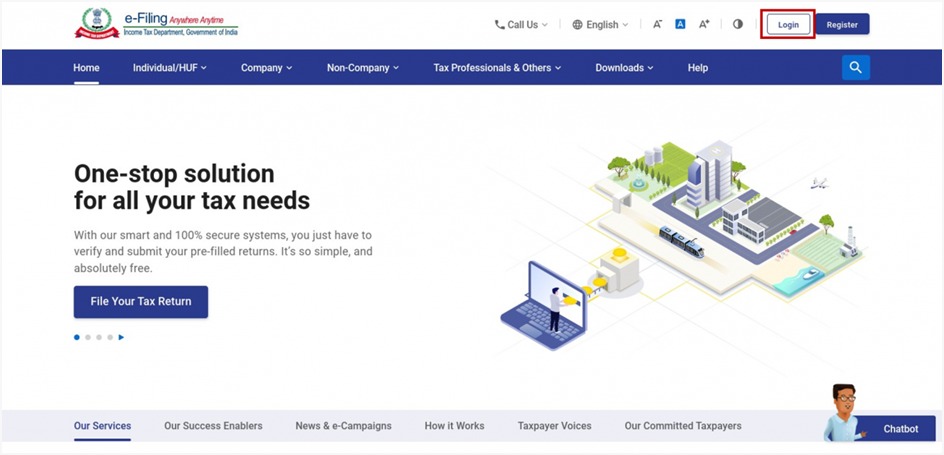

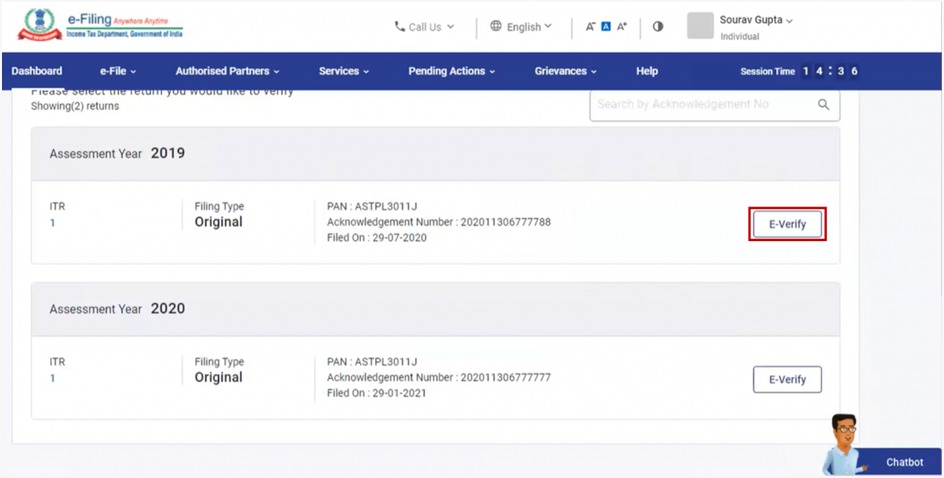

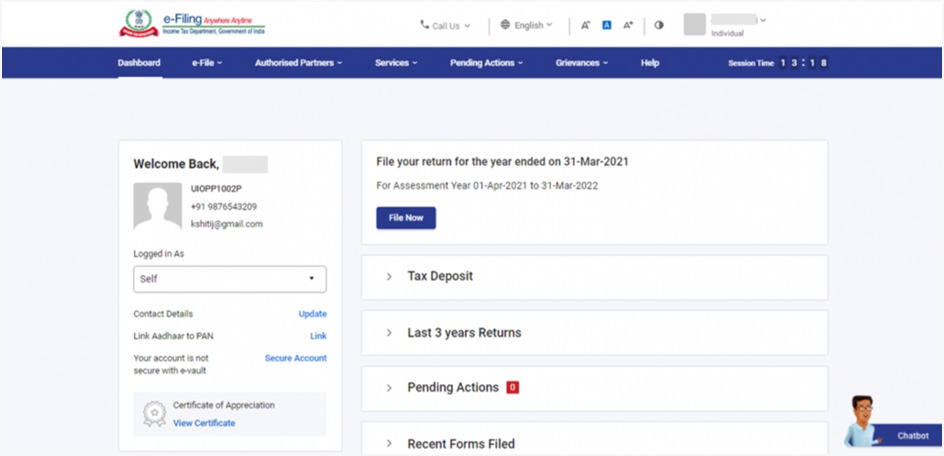

How to e Verify ITR by Logging in to the e-Filing Portal?

Login using user ID and password.

| S.No | Methods |

|---|---|

| 1 | e-Verify your ITR (immediately after filing) or any other Income Tax related submissions / services / responses / requests using the following options: |

| a | DSC |

| b | Generate Aadhaar OTP |

| c | Existing Aadhaar OTP |

| d | Existing EVC |

| e | Generate EVC through Bank Account |

| f | Generate EVC through Bank Account |

| g | Net Banking** |

| h | Generate EVC through Bank ATM option (offline method) |

| 2 | e-Verify your ITR pre-login / post login. Applicable in case of the following: |

Methods to Verify ITR

It is important to e verify the return in 120 days. You can either complete the process of verification online by e-verification or by physically submitting the ITR-V to CPC, Bangalore. Given below are the methods one can use to complete the process of e-verification of ITR:

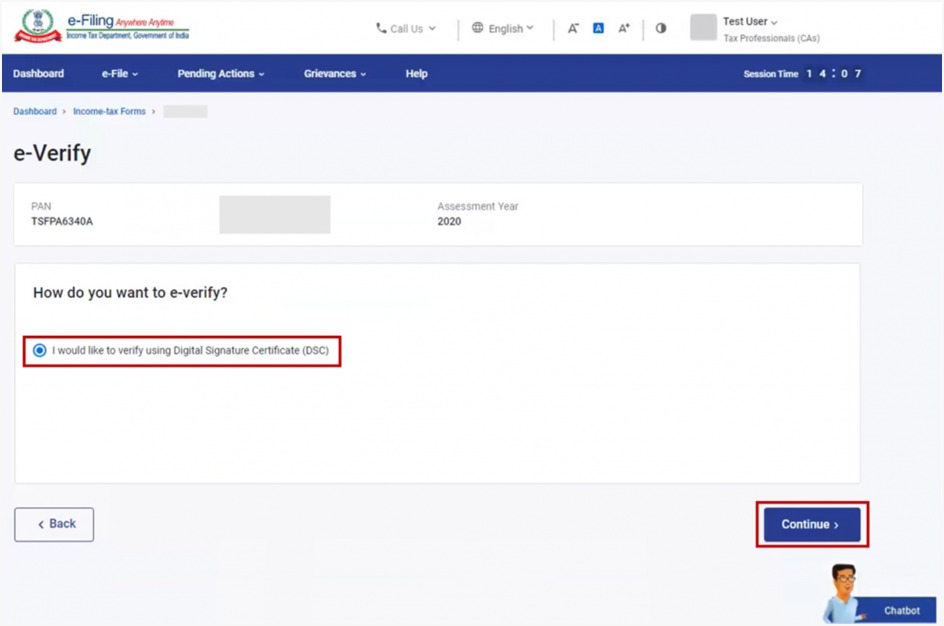

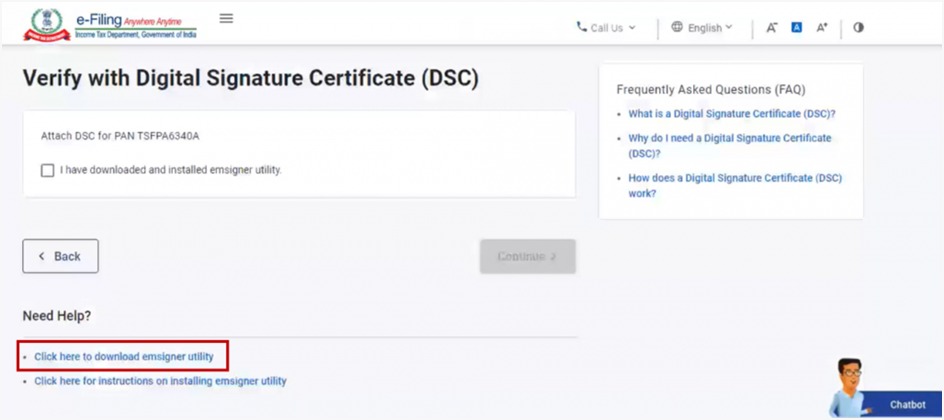

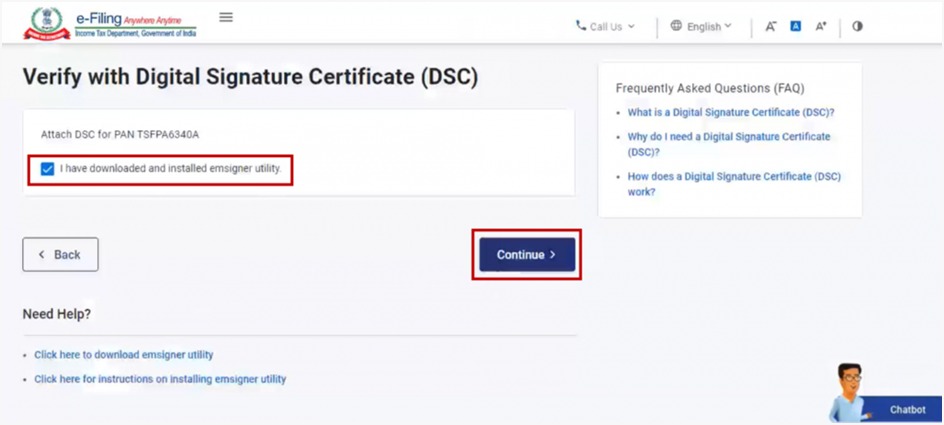

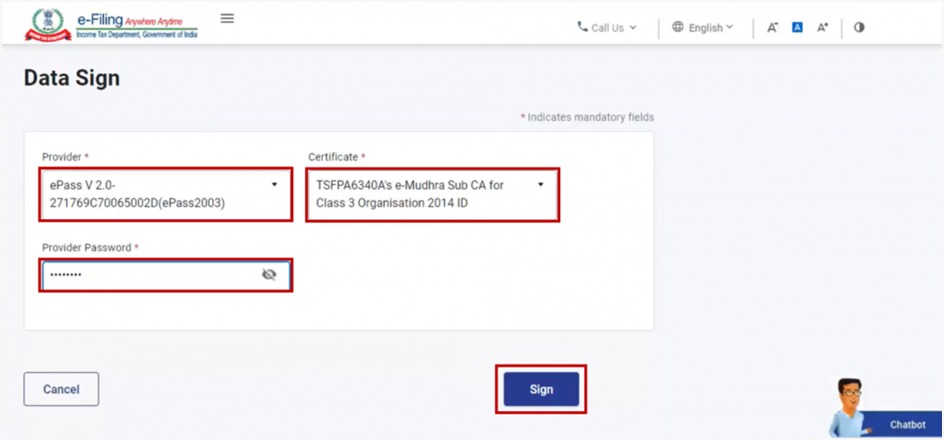

e Verify ITR using DSC

You will not be able to e-Verify your ITR using Digital Signature Certificate if you select the e-Verify Later option while submitting Income Tax Return. You can use DSC as an e-Verification option if you choose to e-Verify your ITR immediately after filing.

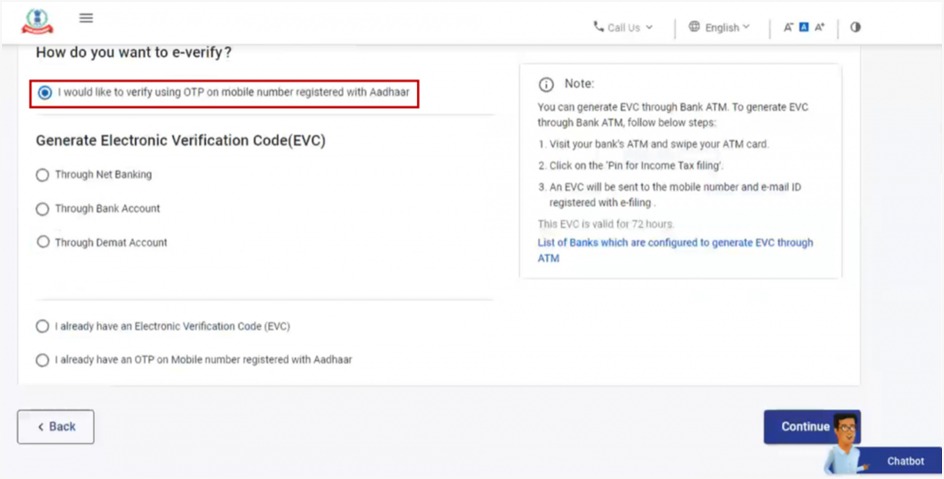

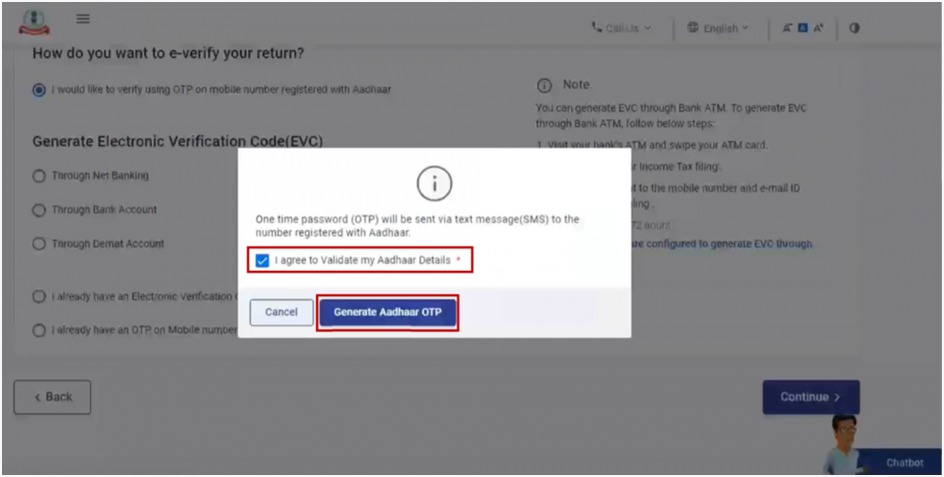

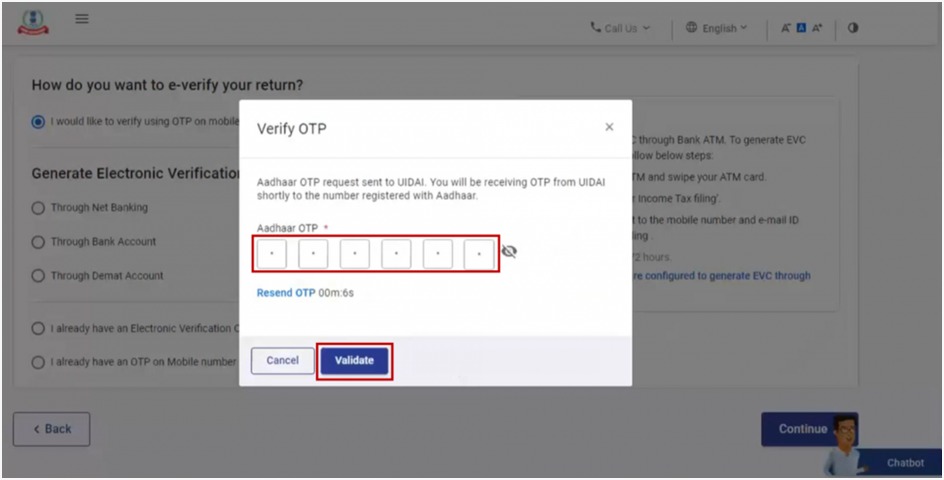

e Verify ITR using Aadhaar OTP

To verify your ITR using this method, you will be required to link your Aadhaar to your registered mobile number. Moreover, you must also link your PAN to your Aadhaar.

You can also choose the option to e verify your return using the existing Aadhaar OTP by clicking on the option “I already have an OTP on Mobile number registered with Aadhaar” and enter the 6 digit OTP.

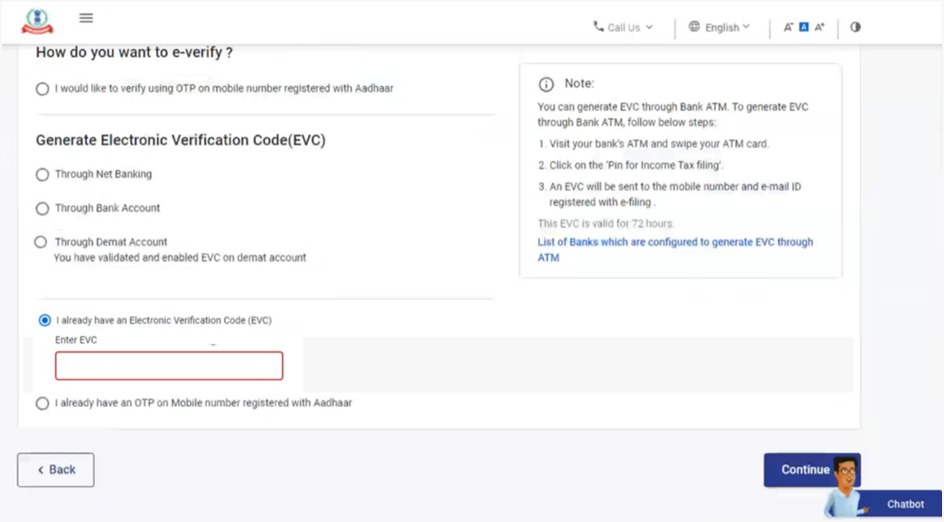

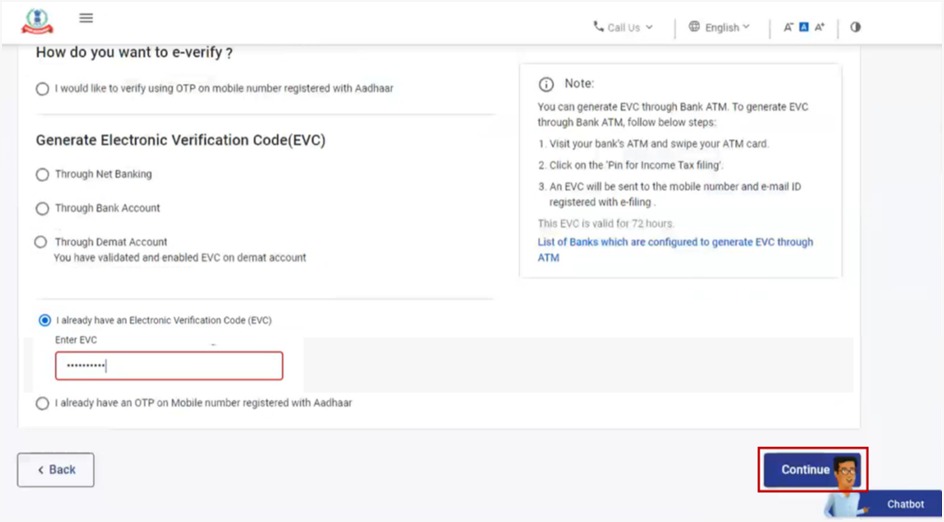

e Verify using Electronic Verification Code – EVC

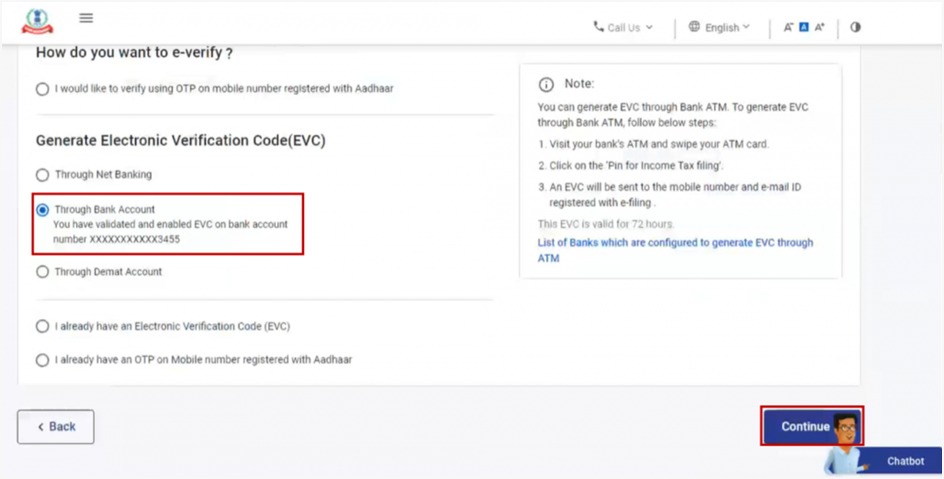

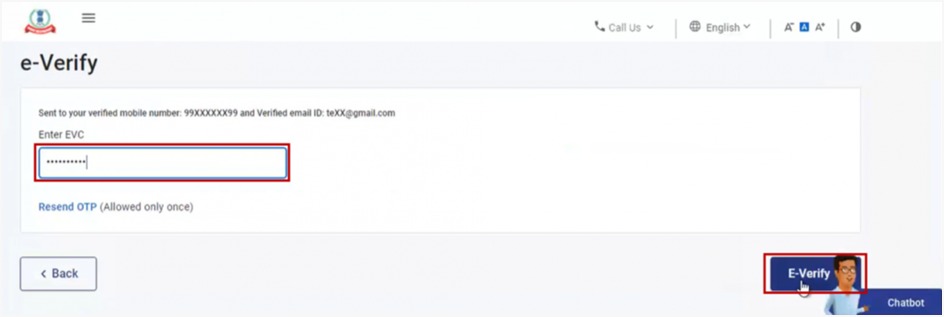

e Verify ITR using Bank Account

This facility is only applicable to certain banks. Moreover, you would also need to prevalidate your bank account on the portal. The process of prevalidation is successful only if the PAN matches the bank account records.

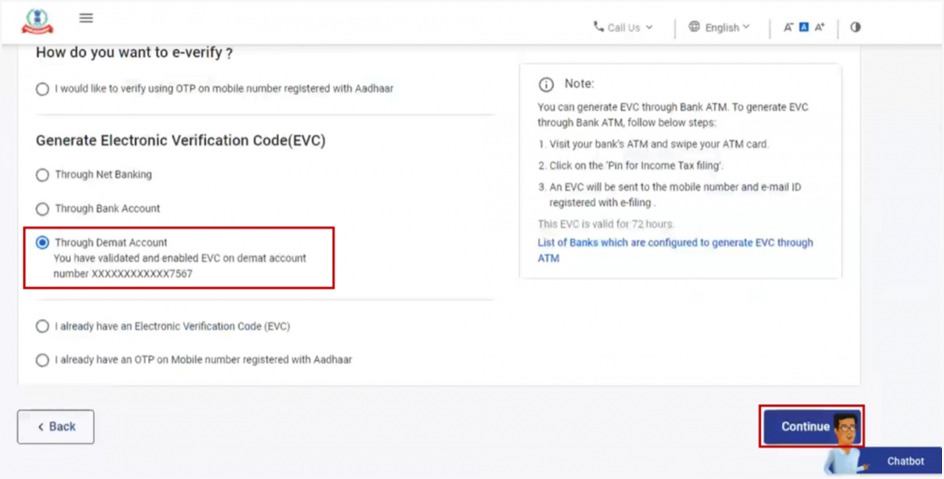

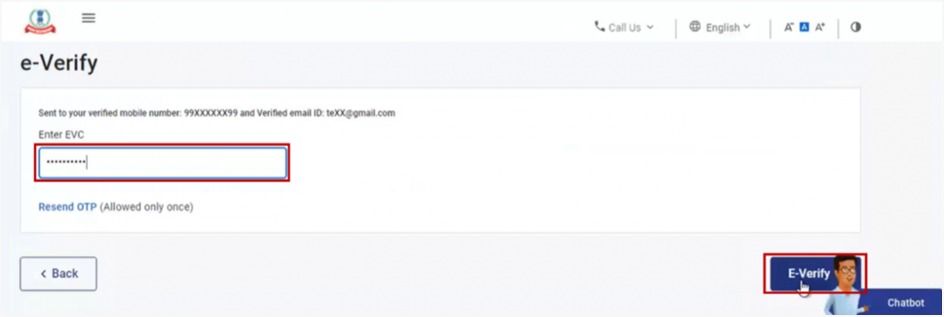

e Verify ITR using Demat Account

This method is similar to the Bank Account method. In this case, too, you will have to prevalidate your Demat Account on the Income Tax e-Filing portal. This process takes 1-2 hours and in case of any error, you receive an e-Mail on the registered e-Mail ID. Hence, you can generate an EVC to complete the process of ITR verification.

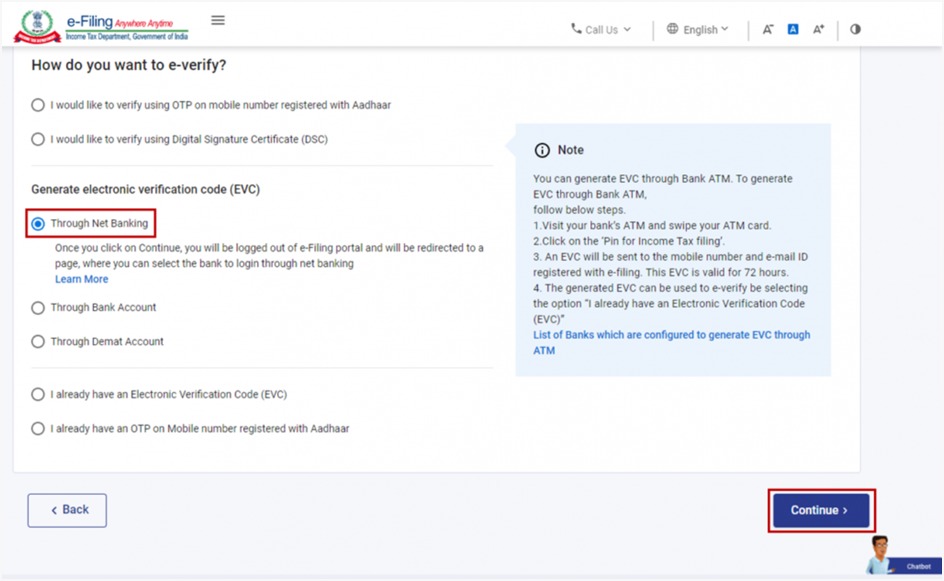

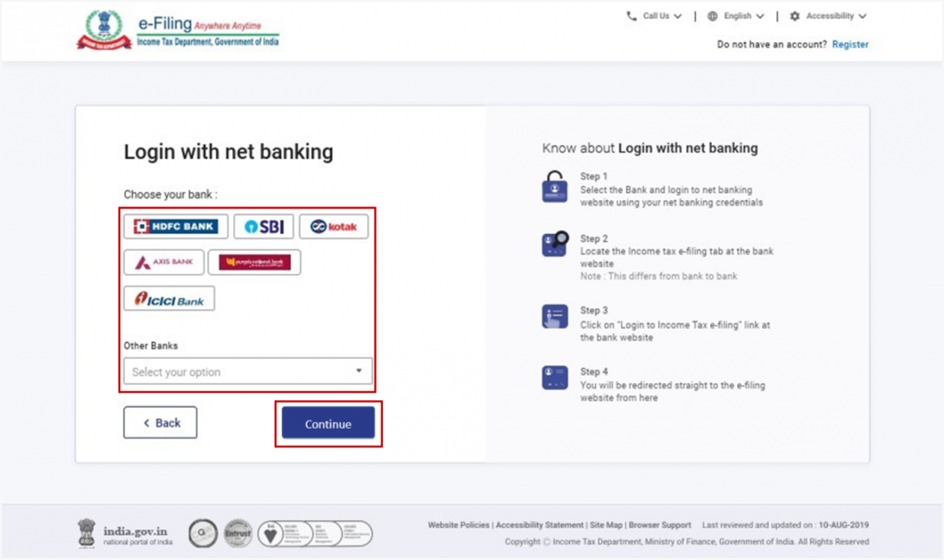

e Verify ITR using NetBanking

You can go ahead with this method if you have availed the Netbanking of your bank account. On the e-Verify page, select Through Net Banking and click Continue.

Verify ITR using Bank ATM – Offline Method

Similar to the netbanking method, the Income Tax Department offers this facility to generate code through the bank ATM to select banks. Therefore, the EVC generated through this process is valid for 72 hours. The code is sent to your registered mobile number.

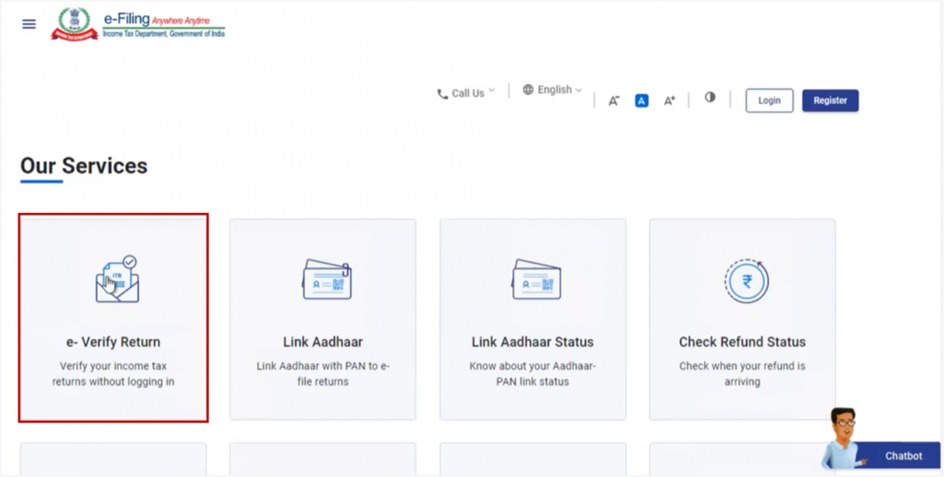

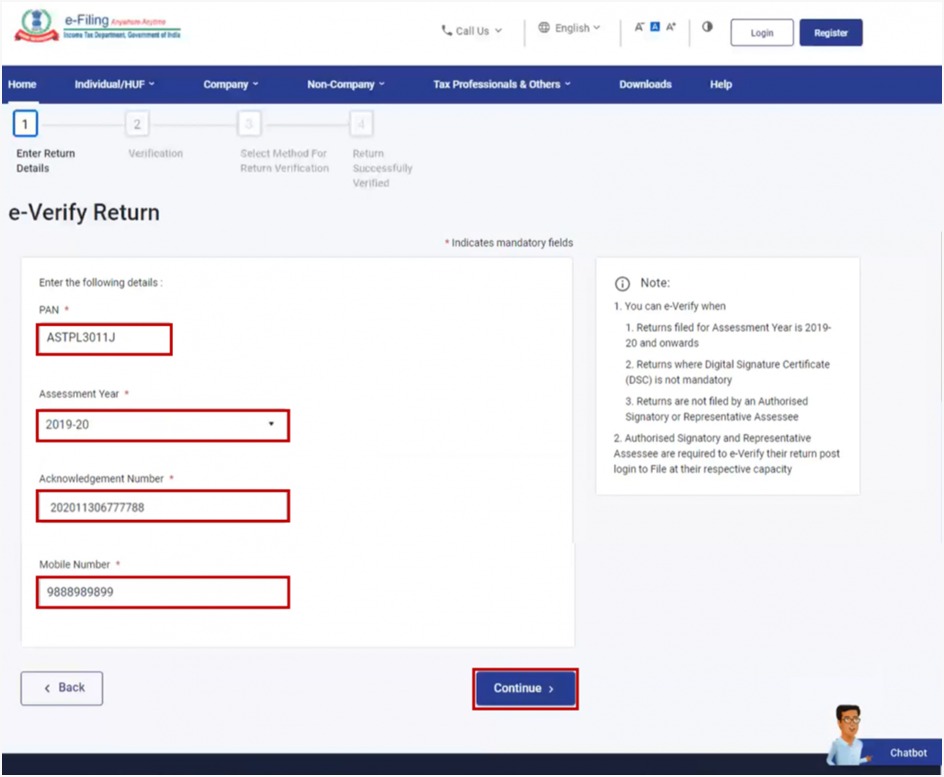

e Verify Return without Logging in to the e-Filing Portal

Send ITR-V to CPC

If it is not possible to electronically verify your ITR, you can physically verify it. You will have to send a signed copy of the ITR-V to Income Tax Department. Following is the list of the important points you need to remember while following this process:

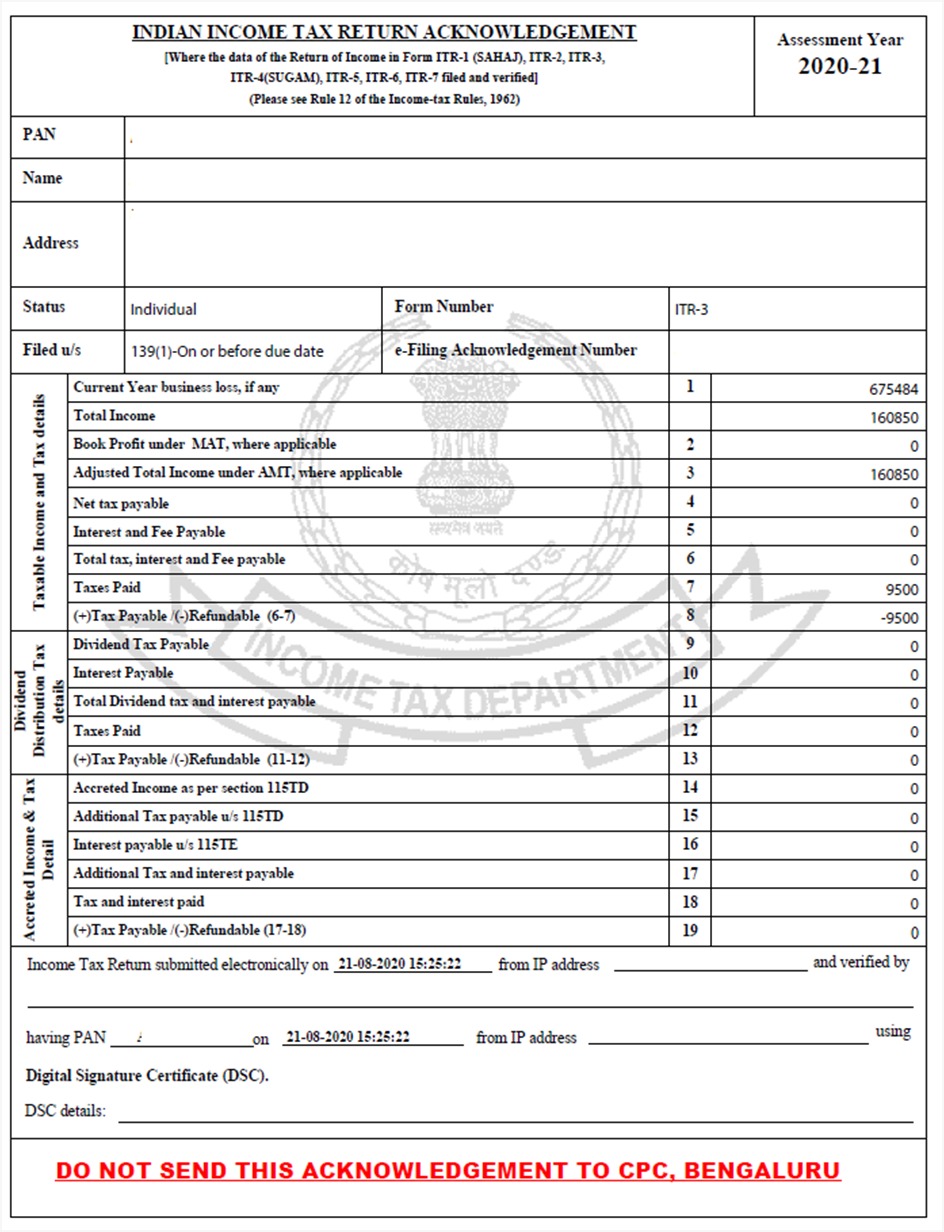

Sample ITR-V Form

Track Your ITR Status

Check your Income Tax Return Status using the PAN and Acknowledgment number - which is allocated by the Income Tax Department after filing your ITR.

ExploreService